What is the Business Cycle

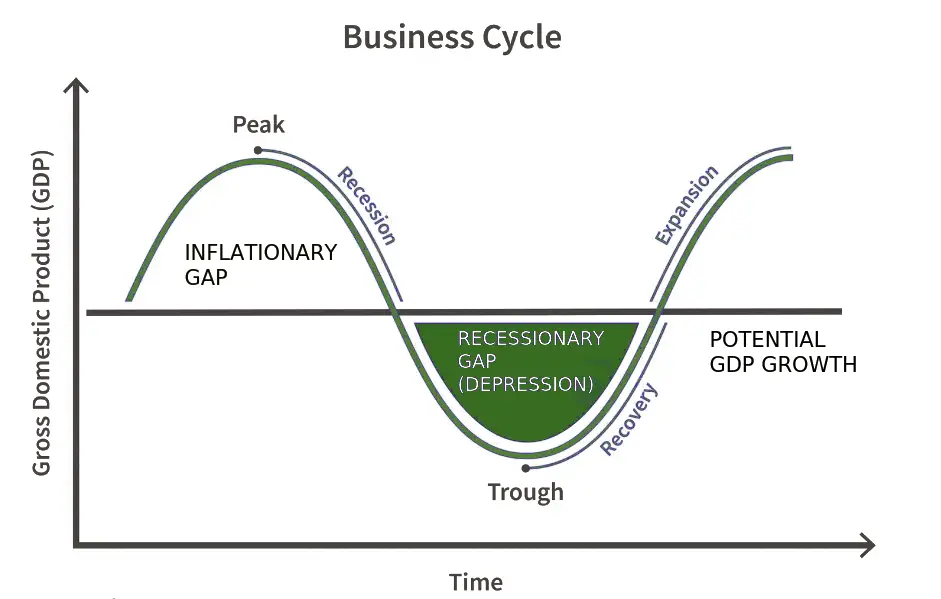

The business cycle refers to the recurring fluctuations in economic activity, characterized by periods of expansion and contraction. These fluctuations are typically measured by changes in real GDP (Gross Domestic Product).

Business Cycle Definition

A business cycle is a recurring pattern of economic activity, consisting of periods of expansion (growth) and contraction (recession) in economic activity. These cycles are not regular or predictable in their duration or intensity.

Phases of Business Cycle

- Expansion: This is a period of economic growth characterized by increasing GDP, rising employment, and falling unemployment. Consumer and business confidence are high, leading to increased spending and investment.

- Peak: The peak marks the highest point of economic activity in the cycle. Economic growth slows down, and inflationary pressures may emerge.

- Contraction: This is a period of economic decline characterized by falling GDP, rising unemployment, and declining consumer and business confidence. This phase is often referred to as a recession.

- Trough: The trough represents the lowest point of economic activity in the cycle. Economic growth reaches its minimum, and unemployment reaches its peak.

Nature of Business Cycle

- Cyclical nature: The most prominent characteristic is their cyclical nature, with recurring periods of expansion and contraction. However, the length and intensity of these cycles vary significantly.

- General nature: Business cycles are a pervasive phenomenon, affecting most economies around the world. They impact various sectors of the economy, including production, employment, and investment.

Types of Business Cycle

- Kondratieff Waves (Long Waves): These are long-term cycles, lasting 50-60 years, driven by major technological innovations.

- Juglar Cycles (Medium Waves): These are medium-term cycles, lasting 7-11 years, associated with fluctuations in investment and inventory levels.

- Kitchin Cycles (Short Waves): These are short-term cycles, lasting 3-4 years, primarily driven by fluctuations in inventory levels.

Business Cycle Theory

Various economic theories attempt to explain the causes and mechanisms of business cycles:

- Hawtrey Monetary Theory: This theory emphasizes the role of credit and money supply in driving business cycles.

- Innovation Theory: This theory, associated with Joseph Schumpeter, argues that technological innovations trigger periods of rapid economic growth, followed by periods of adjustment and decline.

- Keynesian Theory: This theory highlights the role of aggregate demand fluctuations in driving business cycles.

- Hicks Theory: This theory, based on the concept of multipliers and accelerators, explains how small shocks can amplify and propagate through the economy.

- Samuelson theory: This theory utilizes a mathematical model to demonstrate how fluctuations in investment can generate cyclical behavior in the economy.

Conclusion

Business cycles are a fundamental feature of capitalist economies. Understanding their causes and consequences is crucial for policymakers and businesses to make informed decisions and navigate economic fluctuations effectively.